What states do not require malpractice insurance?

By Jackie Farley January 17, 2026

What states do not require malpractice insurance?

Understanding the legal requirements for physicians (and what states do not require malpractice insurance) is a must for both new and experienced doctors. Medical malpractice insurance provides critical protection against claims of negligence or errors in patient care, but not every state mandates physicians carry it. This can create confusion for physicians relocating, opening a practice or negotiating employment contracts.

To navigate these differences, it’s important to understand medical malpractice insurance requirements by state.

What are the two types of malpractice insurance?

Physicians must first understand the two main types of coverage, which can influence both premiums and legal protection. These distinctions also affect physician malpractice insurance rates by state:

- Claims-made policies cover incidents that occur and are reported during the policy period. Switching insurers may require “tail coverage” to maintain protection for past incidents.

- Occurrence policies cover any incident that occurred during the policy period, regardless of when the claim is filed. These are generally more expensive upfront but provide long-term security.

The type of policy chosen can significantly affect rates across different states, especially where state regulations or litigation climates impact premiums.

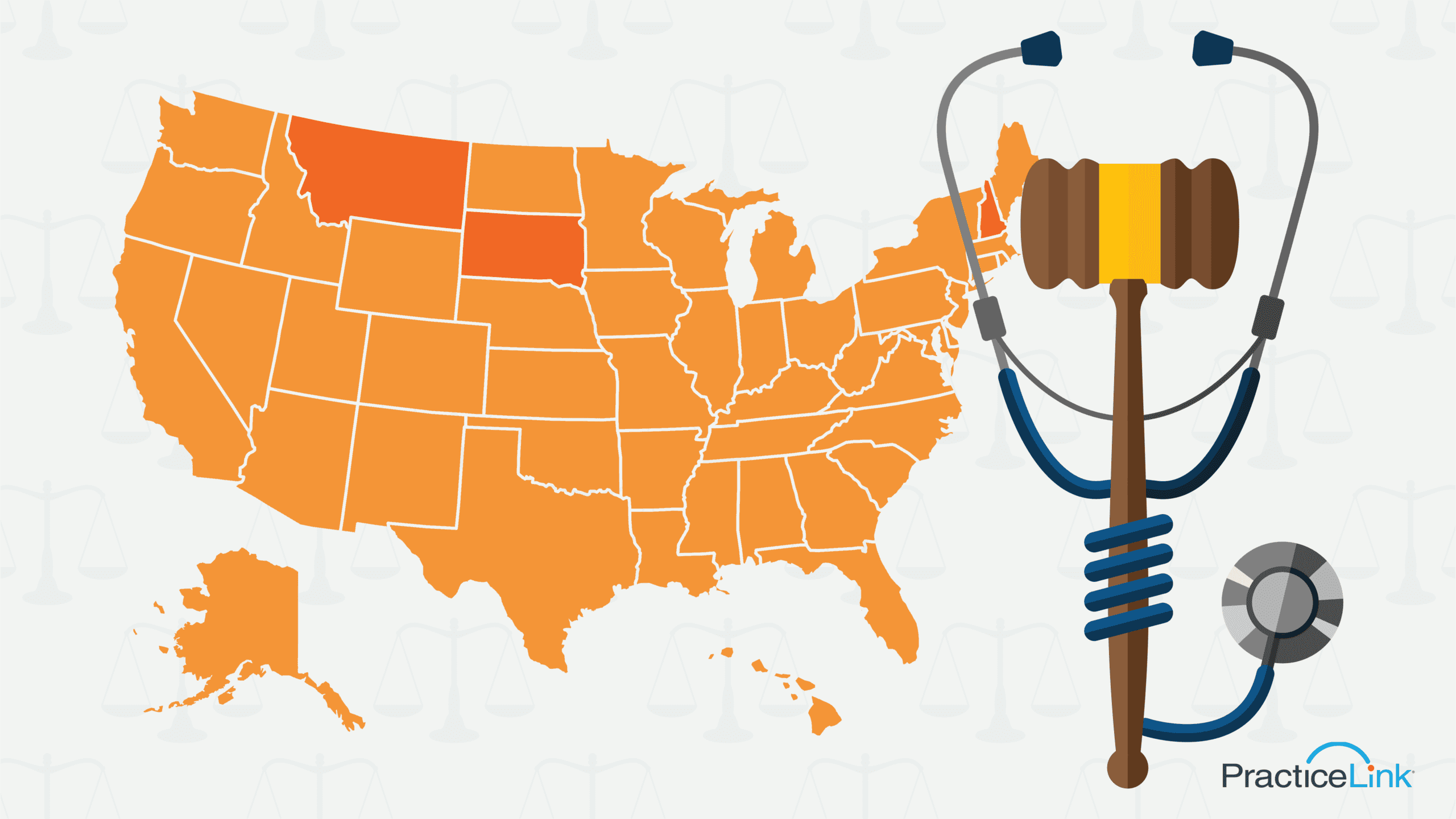

What states do not require malpractice insurance?

When evaluating which states do not require medical malpractice insurance, it’s important to note very few states leave physicians entirely unprotected by mandate. Generally, most states strongly recommend coverage, but certain states have no legal requirement for private practitioners to maintain malpractice insurance.

Examples include:

- Montana – No statutory requirement for private coverage, though some healthcare facilities may mandate it

- New Hampshire – Physicians may choose to practice without insurance, but hospitals typically require coverage for privileges

- South Dakota – Insurance is not mandated by state law, but professional organizations strongly advise it

Even in these states, physicians may still face contractual obligations from employers, hospitals or group practices that require coverage. Choosing to practice without insurance exposes doctors to potential personal liability.

What states require malpractice insurance?

Conversely, many states impose explicit medical malpractice requirements by state, particularly for physicians in high-risk specialties or those practicing in hospitals. These requirements often include:

- Minimum coverage limits, e.g., $1 million per occurrence and $3 million aggregate

- Proof of insurance for licensing or renewal

- Special provisions for high-risk procedures such as obstetrics or surgery

States with strict requirements include New York, California, Florida and Texas. Physicians in these jurisdictions must maintain coverage or risk fines, license suspension or inability to practice.

What happens if a doctor does not have malpractice insurance?

Failing to carry malpractice coverage carries significant risk. Asking “what does legal malpractice insurance cover?” clarifies why insurance is essential. Policies typically protect against:

- Legal defense costs, including attorney fees and court costs

- Settlements or judgments awarded to patients

- Investigations or licensing board inquiries

Without insurance, physicians may be personally responsible for these costs, which can reach hundreds of thousands or even millions of dollars per claim. Additionally, practicing without coverage in states that require it can lead to license suspension or fines, making insurance both a legal and financial necessity.

Knowing what states do not require malpractice insurance is vital for physicians planning their careers, relocating or opening private practices. Even in states without mandates, the financial and legal risks of practicing without coverage are substantial.

Physicians should carefully review state-specific requirements, evaluate their risk exposure and consult trusted advisors to choose the appropriate policy. For more guidance on selecting the right coverage and understanding specialty-specific risks, visit the PracticeLink Resource Center.